Bitcoin Whales and Liquidity Concerns Shake Crypto Market

As August comes to an end, Bitcoin (BTC-USD) is trailing traditional assets due to growing pressure from possible large-scale sell-offs by government agencies and creditors of the defunct Mt. Gox platform. The bitcoin market is currently experiencing a great deal of uneasiness due to this circumstance.

Government and Mt. Gox Holdings

Governments across the globe, including those in the US, China, the UK, and Ukraine, may be possible sources of Bitcoin disposals, according to research from Kaiko. It is also anticipated that creditors of Mt. Gox will contribute to a potential $33 billion supply overhang.

Want to Trade Bitcoin? Sign up now and receive a $25 bonus

Bitcoin Market Liquidity Challenges Intensify Price Volatility

According to Kaiko, the US is estimated to retain roughly 203,220 Bitcoins, China to hold 190,000, the UK to hold 61,200, and Ukraine to hold 46,350. There are still about 46,170 Bitcoins available for distribution on the Mt. Gox exchange.

It has been observed by Kaiko analysts Adam Morgan McCarthy and Dessislava Aubert that the existence of these “prominent holders” may result in more selling pressure in the months to come. These elements, along with a decrease in market liquidity, have contributed to Bitcoin’s 8% slide this month. Despite minor improvements in traditional stock and bond indices.

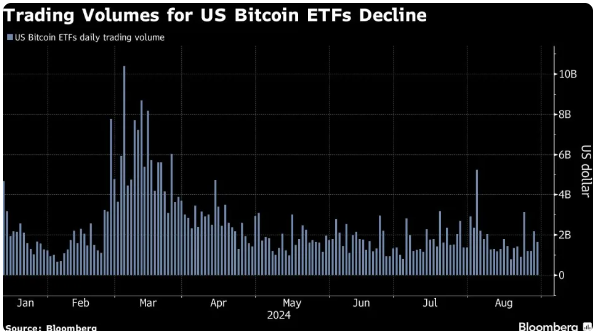

Deteriorating ETF Liquidity Compounds Market Issues

The recent volatility, according to Sean Farrell, head of digital-asset strategy at Fundstrat Global Advisors LLC, has been exacerbated by the low spot market volumes for Bitcoin. Farrell also pointed out that since March’s peak, the seven-day average turnover of Bitcoin has dropped dramatically.

Read more Elon Musk and Tesla Secure Victory in Dogecoin Pyramid Scheme

Strategy analysts at JPMorgan Chase & Co. note that US Bitcoin ETF liquidity is declining, which further muddies the trading environment. A measure of liquidity called the Hui-Heubel ratio shows that fewer trades are required to shift prices. Less than $2 billion is the daily trading volume for US Bitcoin ETFs, down from nearly $10 billion in March.

On Friday in London, the price of Bitcoin was roughly $59,535, which is almost $14,000 less than its peak in March. The performance of other cryptocurrencies, including Ether and Solana, was inconsistent.

Are you prepared to begin trading cryptocurrencies? Get a welcome bonus of $25 USDT when you sign up today. Don’t wait around start investing right away!

For More Crypto News Visit Made For Bitcoin

Follow US

Welcome to your daily source for the latest cryptocurrency news, Binance insights, and more! Explore the most recent advancements on blockchain technology, NFTs, trading methods, and more. Your contribution fuels our objective of delivering relevant, interesting material to your feed every day.