If you want to know why many people get stuck in a TRAP of a cryptocurrency, waiting like so badly for a crypto to reach at high price level so that they can sell off to achieve passive income. Because they search for coins price predictions and these predictions are always not accurate. Here are some reasons why these price predictions are not always going to satisfy you. But, these are some market tactics to keep a user hold on to their investments, there are very few cases that these predictions work.

Reasons why cryptocurrency price predictions are not always accurate

Unforeseeable events

Cryptocurrency marketplace is very volatile, and unforeseeable events like global pandemics, political instability, or unexpected economic downturns can have a significant impact on cryptocurrency prices.

Such events are often impossible to predict because they just happen out of the blue. You can find things happening unexpectedly and that makes the market price swings, drastically.

Lack of historical data

Sometimes, it is hard to find the background data of a cryptocurrency either they are new to the market or historical data is often limited which not only makes it hard to predict future prices but it is also suggested to stay away from such asset.

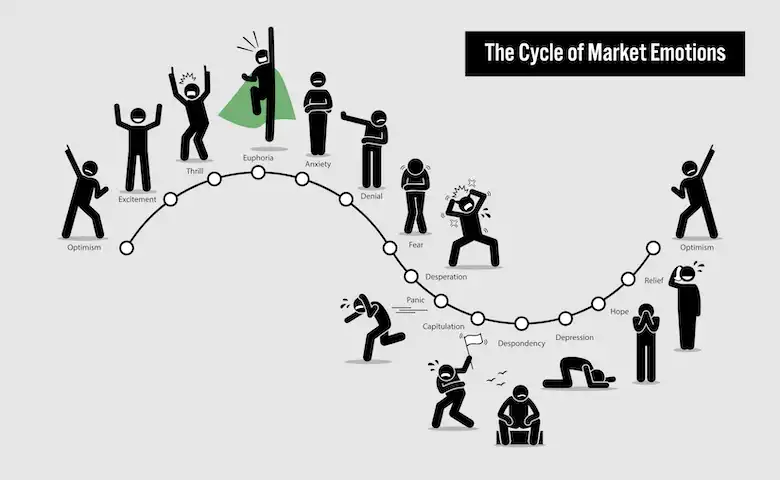

Market sentiment

Crypto marketplace is largely driven by investor sentiment, which can be difficult to predict.

Positive or negative news can significantly impact market sentiment which cause sudden changes to the market and significant price swings.

Regulatory changes

Cryptocurrencies operate in a largely unregulated market, but changes in regulatory policy can have a significant impact on prices.

New regulations or crackdowns on cryptocurrency can cause sudden drops in price, and investors may not be able to predict these changes.

Lack of liquidity

Cryptocurrency markets are relatively small compared to other asset classes, and lack of liquidity can make it difficult to accurately predict prices.

Small trades can cause significant price movements, and liquidity can be affected by a variety of factors including market sentiment, adoption rates, and regulatory changes.

- Image source: lehnerinvestments