Crypto Today – Major Moves and Key Updates You Need to Know

The Open Network (TON) appears to be making waves, but not for the reasons it had hoped for. Pavel Durov, the creator of Telegram, was detained in Paris, and there have lately been disturbances due to an airdrop of meme coins. Beyond TON’s issues, though, there are some big announcements in the crypto space today.

Below is a brief summary of the major developments of today:

Open Network Nvidia’s Record Quarter

Roaring GPU sales, high expectations for upcoming Blackwell chips, and strong performance in data services both domestically and internationally have propelled Nvidia to report a Q2 revenue of $30 billion, exceeding expectations by $2 billion. Projections for Q3 are even higher at $32.4 billion.

Telegram’s Durov Faces Legal Hurdles

CEO of Telegram Pavel Durov was arrested on August 24 at a Paris airport; he was freed, but he is now subject to French court monitoring. Durov is accused of a number of offenses, including trafficking and involvement in child pornography. The future of Telegram and its integration with Toncoin are called into question by this circumstance.

Want To Trade Bitcoin? Sign up now and receive a $25 USDT bonus

SEC Cracks Down on NFTs

With the issuance of a Wells Notice that may result in legal action, the SEC has taken action against OpenSea. Devin Finzer, CEO of OpenSea, views this as a threat to artists and creators, and the main question is whether some NFTs are eligible to be treated as securities.

Stacks’ Nakamoto Upgrade

Stacks’ Nakamoto upgrade is expected to improve Bitcoin’s performance by adding sBTC, a programmable Bitcoin asset, and possibly speeding up transaction times. The goal of this update is to preserve decentralization while bridging Bitcoin and Stacks.

TON’s Meme Coin Meltdown

After a DOGS token airdrop, TON encountered a network outage that caused traffic congestion and network outages. The airdrop, which was connected to Spotty, the mascot of Telegram, overwhelmed validators and momentarily stopped consensus procedures.

Read More: Importance of Bitcoin Self-Custody ‘Not Your Keys, Not Your Coins

Market Analysis

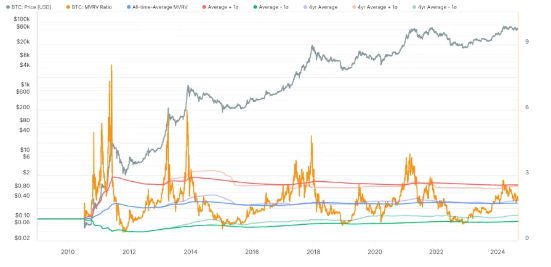

The dynamics of the bitcoin market are moving in the direction of equilibrium, and investor mood is at a critical point. Previous trends indicate that there may be more volatility before this quiet time. A potential transition phase is indicated by metrics such as the perpetual swap market funding rates and the MVRV Ratio.

Glassnode Insights

The net realized profit/loss displayed by Glassnode data has significantly decreased, indicating a departure from the peak capital inflows saw during Bitcoin’s all-time highs. This reset could indicate a move towards bearish conditions or a continuation of the current trend.

What You Should Do

Recall that this research is not intended to be financial advice; rather, it is based on current data. Always do your own homework and evaluate your financial status before to making any kind of investment.

Now is a great moment to get started if you want to start trading. Register now to receive $25 USDT upon enrollment. Don’t pass up this opportunity to increase your trade chances and participate in the fascinating cryptocurrency industry.

For More Crypto News Visit Made For Bitcoin

Follow US

Welcome to your daily source for the latest cryptocurrency news, Binance insights, and more! Explore the most recent advancements on blockchain technology, NFTs, trading methods, and more. Your contribution fuels our objective of delivering relevant, interesting material to your feed every day.